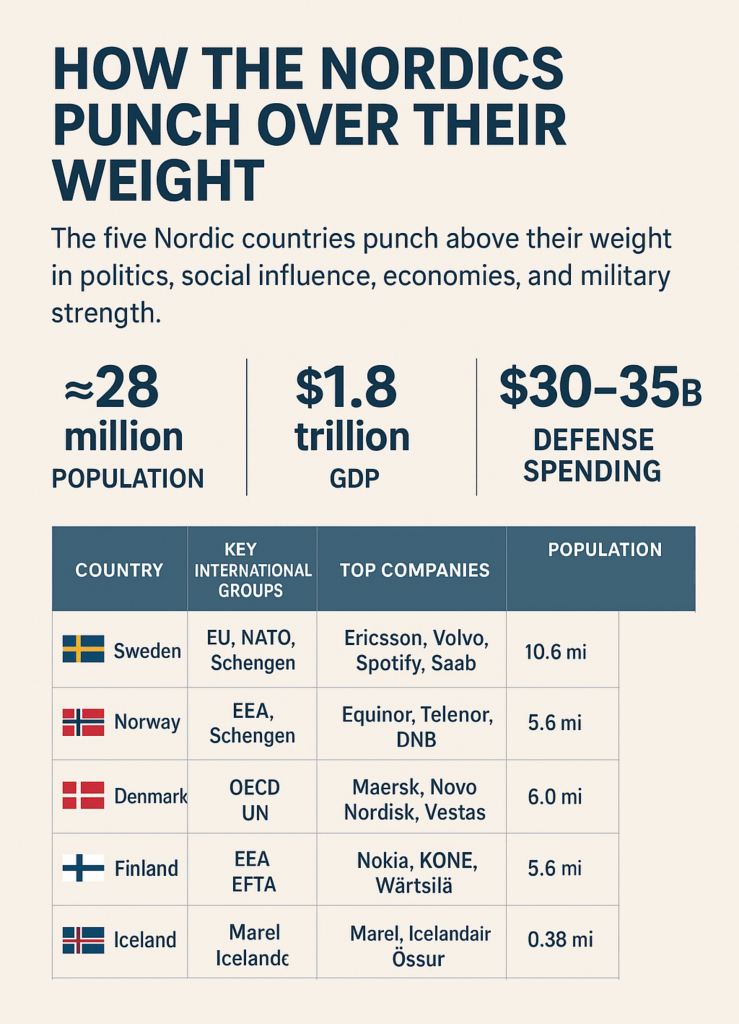

The five Nordic states work far above their headcount. While they have small populations, they hold outsized economic clout. They field modern militaries and high-tech industries. They shape global norms and networks. Let’s see how the group would rank if it acted as one country.

The basics in one line

The population of the five Nordics combined: about 28 million. Nominal GDP combined: roughly $1.8 trillion. These numbers make the Nordics a mid-sized player that behaves like a much larger power. (World Bank; Nordic Council). (World Bank Open Data)

Why size understates influence

- High per-capita wealth. Each Nordic state ranks among the richest on Earth by GDP per capita. This funds strong public services, research, and exports. (World Bank). (World Bank Open Data)

- Networked institutions. The Nordics use shared forums, common standards, and pooled expertise through the Nordic Council and regular bilateral cooperation. That multiplies impact. (Norden)

- Global corporations. The region hosts market leaders in shipping, energy, pharma, telecoms, and tech. These firms project Nordic standards, tech and capital worldwide. (Wikipedia)

- Strategic geography. The Baltic and Arctic positions matter to NATO and to energy routes. Geography converts regional policy into global leverage. (Financial Times)

Defence and security

All five Nordics now sit inside NATO and allied frameworks, which tightens regional deterrence. Finland and Sweden recently joined NATO; Norway, Denmark and Iceland were already members. Their spending and readiness rose after Russia’s 2022 invasion of Ukraine. SIPRI and national budgets show steady increases. That makes the Nordic bloc more consequential than raw troop numbers suggest. (NATO)

Economic muscle

The Nordics combine strong export sectors, large sovereign funds and high-value firms:

- Norway’s sovereign wealth fund gives it unique financial reach. (Reuters)

- Denmark produces global pharma leader Novo Nordisk and shipping giant Maersk. (Wikipedia)

- Sweden hosts Ericsson, Volvo, Atlas Copco and Spotify. (Verbolsa.com)

- Finland fields Nokia, KONE and significant cleantech exporters. (Companies Market Cap)

- Iceland exports seafood, energy services and niche tech through firms like Marel. (Bullfincher)

Those firms place Nordic rules, tech and capital into global supply chains. That translates into diplomatic influence in trade, climate, and tech governance. (CEOWorld Magazine)

Soft power and norms

The Nordics punch above their weight in ideas and standards. They export regulatory models, data and privacy practices, and welfare policy templates. Their universities and think tanks shape debate on energy policy, equality, and green tech. That gives them moral authority in multilateral settings. (Wikipedia)

If the Nordics were one country — compact rankings

Below shows each state, memberships, top companies, population, GDP and military spending figures where available. The final row sums the five into a single “Nordic union” column and gives approximate global ranks for population, GDP and defence scale.

| Country | Key international groups | Top companies (sample) | Population (2024 est) | Nominal GDP (approx, US$) | Military spending / year (approx, US$) |

|---|---|---|---|---|---|

| Sweden | EU, NATO (joined 7 Mar 2024), Schengen, OECD, UN | Ericsson, Volvo, Spotify, Saab | 10.6M. (World Bank Open Data) | $610B (2024 est). (Trading Economics) | rising, budget boost planned; SIPRI trend shows increases. (Reuters) |

| Norway | NATO, EEA, Schengen, OECD, UN | Equinor, Telenor, DNB | 5.6M. (World Bank Open Data) | $484B (2024 est). (Trading Economics) | ≈ $8–9B (2023 data). (MacroTrends) |

| Denmark | EU, NATO, Schengen, OECD, UN | Maersk, Novo Nordisk, Vestas | 6.0M. (World Bank Open Data) | $407B (2023 est). (World View Data) | ≈ $8B (2023). increased commitments announced. (MacroTrends) |

| Finland | EU, NATO (joined 2023), Schengen, OECD, UN | Nokia, KONE, Wärtsilä | 5.6M. (World Bank Open Data) | $300B (2024 est). (World Bank Open Data) | rising since 2022; SIPRI/World Bank show increases. (SIPRI) |

| Iceland | NATO, EFTA, EEA, Schengen, OECD, UN | Marel, Icelandair, Össur | 0.38M. (World Bank Open Data) | $31B (2023 est). (Worldometer) | negligible active forces; defence tied to NATO arrangements. (CEIC Data) |

| Combined “Nordics” | Nordic Council, EU/EEA/Schengen/NATO mix | Maersk, Novo Nordisk, Equinor, Ericsson, Nokia, Spotify, Marel | ≈ 28.1M (sum). World Bank / Nordic Council aggregate ~28M. (World Bank Open Data) | ≈ $1.8T (sum of national nominal GDPs). That sits near the low-mid teens globally by GDP. See world GDP lists. (World Bank Open Data) | Combined defence spending roughly $30–35B per year (sum of national budgets, recent years). That places the bloc well above many medium states, but below the largest spenders. SIPRI shows the regional rise since 2022. (SIPRI) |

Key sourcing: World Bank for population and GDP series. NATO for membership dates. SIPRI for military trends. Market-cap and corporate lists from up-to-date market-cap aggregators and national company lists. (World Bank Open Data)

What those combined ranks mean

- Influence is concentrated. With $1.8 trillion in GDP the Nordics would be comparable to a top 15 economy. That wins attention in trade talks. (Worldometer)

- Security matters more. NATO membership and rising budgets give leverage in defence planning across Northern Europe. (NATO)

- Corporate power scales. A handful of global firms export Nordic standards from corporate boardrooms to distant markets. (Wikipedia)

Limits and caveats

- The Nordics are diverse. EU membership, currency use and defense postures differ. That limits formal integration. (Wikipedia)

- GDP and spending figures shift. Markets, energy prices and budgets change annually. I used the latest public datasets and reputable trackers. Where figures varied by source I reported rounded, conservative numbers. (World Bank Open Data)

- If you plan to work with Nordic partners, expect clear rules, robust public institutions and globally competitive firms. You will find high standards, stable contracts and skilled workforces but varied rules. (Norden)

- For security planners, the region has moved from peripheral to central for European defence. That matters for logistics, basing and force posture. (Financial Times)